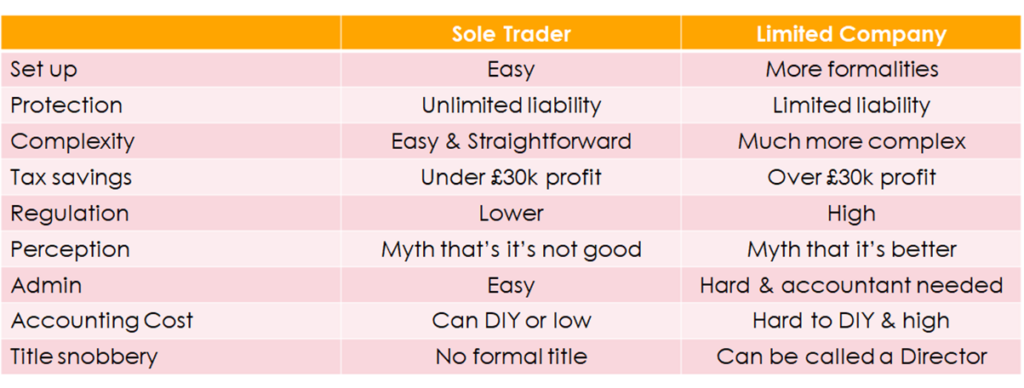

A much asked question with no right or wrong answer – the right structure for your business will depend on your circumstances. We’ll guide you through the considerations and what to be aware of when you’re making this first, of many, key business decision.

What does being Self Employed Mean?

If you work for yourself you are “self employed”.

A self employed person working on their own can operate as a sole trader or a one person limited company.

Sole Trader

By far the simplest of structures is that of a sole trader; a self-employed person working on their own. There is no formality to setting up as a sole trader; basically you just get started.

No distinction exists between you and your business which means that a sole trader (an unincorporated business structure) has unlimited liability. You are personally liable for the debts of the business should it fail. In reality this means creditors (people or businesses that you owe money to) could attempt to recover any amounts owed to them from your personal assets such as, but not limited to, your house or car.

Limited Company

The fear of unlimited liability is often a reason for a business to be set up as a Limited Company; an incorporated business established through a formal process and registered at Companies House.

A limited company has its own separate identity in the eyes of the law meaning that it is very important to keep the financial affairs of the business completely separate from your own finances. In reality this means opening a separate business bank account and applying strict formality around how you extract money from the company.

Ownership

Ownership of a limited company is by way of shares allocated to and purchased by shareholders. The shareholder(s) appoint director(s) to run the business on their behalf. Directors have legal obligations bestowed on them when they are appointed including keeping accounting records and filing accounts. Of course the shareholder and director can be one and the same person as is often the case in an owner managed business.

Limited Liability

The clear advantage of setting up a limited company and trading through such a business structure is the protection of limited liability; if the company fails the debts remain with the limited company and aren’t passed onto its directors unless there has been some wrongdoing, the directors have provided a personal guarantee on any borrowings or more money has been taken out of the business by way of dividends than is available in undistributed profits (termed as taking an illegal dividend).

A personal guarantee means that the directors have assured the lender that should the limited company fail they will pay back the borrowings effectively removing the protection of limited liability.

Things to consider

When deciding which business structure is best

Forced into Limited Company

For freelancers trying to secure work, you may be forced into a Limited Company Structure by your end client. On the face of it this could be deemed to be an illegal restrictive practice although it’s a difficult point to argue when work is at stake. That said, do push back at this as a prerequisite to a contract and, if brave, put your fees up to reflect the costs of the additional administration required for a Limited Company.

Tax Saving

For businesses with larger profits there may be tax savings to be gained if operating under a Limited Company structure. If tax savings are a driver then the Limited Company route should only be considered if profits are in excess of £30,000. Remember that it’s profits (business income or turnover less allowable business costs) and not just income that you should be looking at in this assessment.

Do you need an accountant?

Limited Company

If you do operate a Limited Company you will almost certainly need an accountant to help with your year end accounts as they need to be filed in a certain format requiring special software.

An accountant will also help you to decide how best to pay yourself from the business by way of a salary and dividend mixture as well as explain how to report dividends on your self assessment, run a payroll for you and file a Confirmation Statement. You may be able to do some of these things yourself to reduce accountancy fees if you’ve the time. However, if you miss a deadline there could be quite a hefty fine.

For example, £100 per month if you miss your payroll filing, and up to £1,500 for accounts filed late which would double if you were late in the following year.

Not having a budget set aside for accountancy fees is simply not an option if you operate your business as a Limited Company.

Sole Trader

The accounts and tax returns for a sole trader are much easier and can, in the most part, be done without an accountant if you’ve the time and the inclination.

Accountant

In either case don’t be afraid to outsource your accounts and tax returns to a reputable accountant but make sure you keep control on what you want them to do and agree the fee up front.

Insurance

The unlimited liability attached to operating as a sole trader may be mitigated by taking out appropriate insurances which would give you peace of mind against any potential issues.

Shop around for insurance for your particular profession such as professional indemnity insurance for freelancers, trade insurance or public or employer’s liability insurance.

I want to be a Director

Setting your business up as a Limited Company simply to call yourself a Director should be something to avoid at all costs. Whilst there is a deemed perception that a Limited Company is more well regarded than a sole trader there is little to back this perception up. There needs to be a much more concrete reason to set up as a Limited Company than a title.

Summary

Best Advice

The best advice is to start off as a sole trader testing the waters to see if your business works. The business structure can easily be changed in the future once you’ve proved the business concept and the need for limited liability protection increases as matters become more complex.

Keep things simple at the outset unless there is a compelling reason for complexity but make sure this is matched with the budget to get specialist help from a reputable accountant.